GLOBAL GROWTH IN TERMS OF GROSS DOMESTIC PRODUCT (GDP)

“Global economic activity is experiencing a broad-based and sharper-than-expected slowdown, with inflation higher than seen in several decades. The cost-of-living crisis, tightening financial conditions in most regions, Russia’s invasion of Ukraine, and the lingering COVID-19 pandemic all weigh heavily on the outlook. Global growth is forecast to slow from 6.0 per cent in 2021 to 3.2 per cent in 2022 and 2.7 per cent in 2023. This is the weakest growth profile since 2001 except for the global financial crisis and the acute phase of the COVID-19 pandemic.”

– International Monetary Fund World Economic Outlook October 2022.

Gross Domestic Product (GDP)

Global growth or a country’s growth is usually measured by the Gross Domestic Product (GDP). GDP is a tool used to indicate the status or health of a country’s economy. GDP is nothing but the total value of all goods and services produced within a country during a given time period. In India, GDP is calculated from April of a given year to March of the following year. This is a 12-month period or a financial year. GDP is also calculated on a quarterly basis. But not many people realize that there are many ways of calculating GDP. Let us look at some of the more common ones.

Nominal GDP is the total value of all goods and services produced within the borders of a country at the market value of the goods and services without taking into account inflation. It is normally calculated in the local currency.

Real GDP is GDP that is adjusted for inflation. When measuring the GDP of a country, the market value of the goods and services produced during the year can be distorted by rising prices or inflation or, sometimes, lower prices or deflation. Nominal GDP does not take into account inflation or deflation which results in a misleading picture of the economy whereas real GDP adjusts for inflation.

GDP Per Capita is a measurement of the GDP per person in a country’s population. GDP per capita is arrived at by dividing the total value of the GDP by the total population. India’s GDP per capita is very low not just because of the huge population but also because the value of its economic activity is relatively low. China, another country with a population similar to that of India has a much higher GDP per capita as its economic activity is much higher than India. In contrast, countries with small populations have a very large GDP per capita especially when their countries have high economic activity.

GDP Growth Rate is the change in economic activity on a year-to-year basis or a quarterly basis expressed in percentage terms. This measure of GDP is used by economists to measure a country’s economic performance periodically and understand whether the economy is growing, remains stagnant or is declining in economic activity.

GDP Purchasing Power Parity is a measure used to compare GDP between countries. This is a very important measure as the purchasing power of a currency can differ vastly from country to country. For example, a thousand rupees can be used to purchase much more goods or services in India as compared to the same amount in Europe or the USA. The purchasing power parity essentially helps in cross-country comparisons of real income, real output and living standards.

One of the easy ways to understand GDP is through the expenditure approach, which is the approach used by the US Government. This approach has a formula:

GDP = C + G + I + NX (C = Consumption; G = Government Spending; I = Investment; NX = Net Exports)

From this formula, it is clear that a country’s growth depends on the consumption of its citizens, the spending by the government on purchases, salaries and infrastructure, investment by local and foreign companies in the country and net exports, which are the value of total exports subtracted from total imports. This also means that a country’s growth depends on how much it exports relative to its imports. This is also known as a trade deficit. India’s total imports far exceed its total exports, resulting in a negative trade balance, which in turn affects the growth of the economy.

Global Growth

Many organisations like the IMF, the World Bank, the World Economic Forum and the OECD routinely make predictions on the GDP of countries across the world which are indicators of global growth.

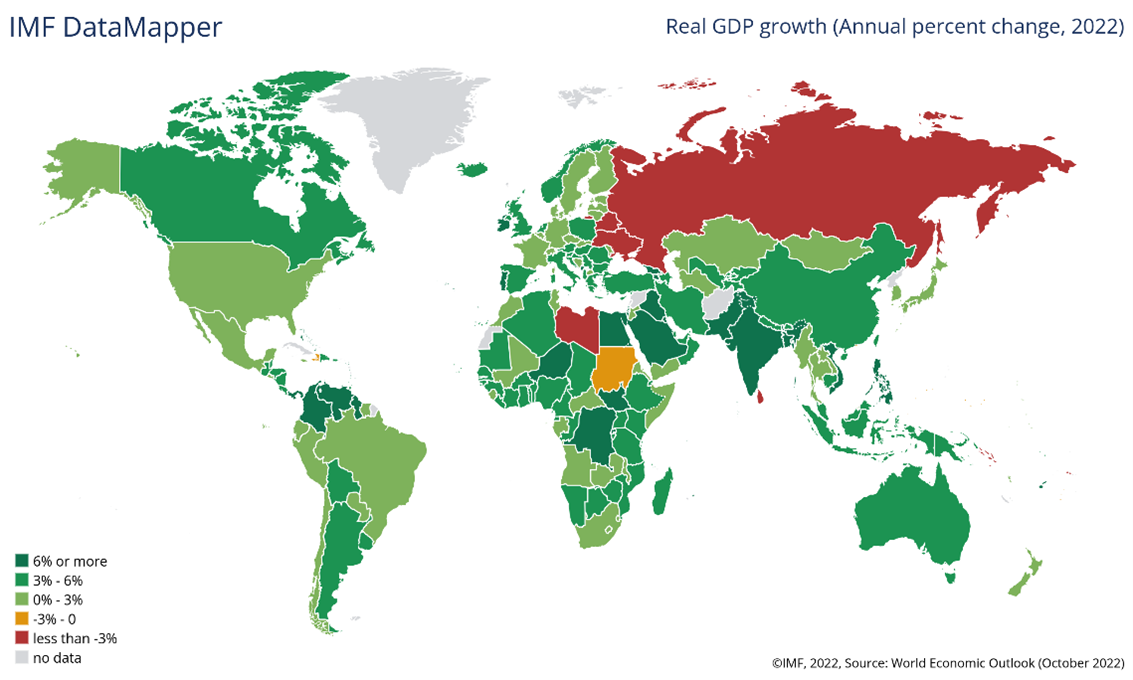

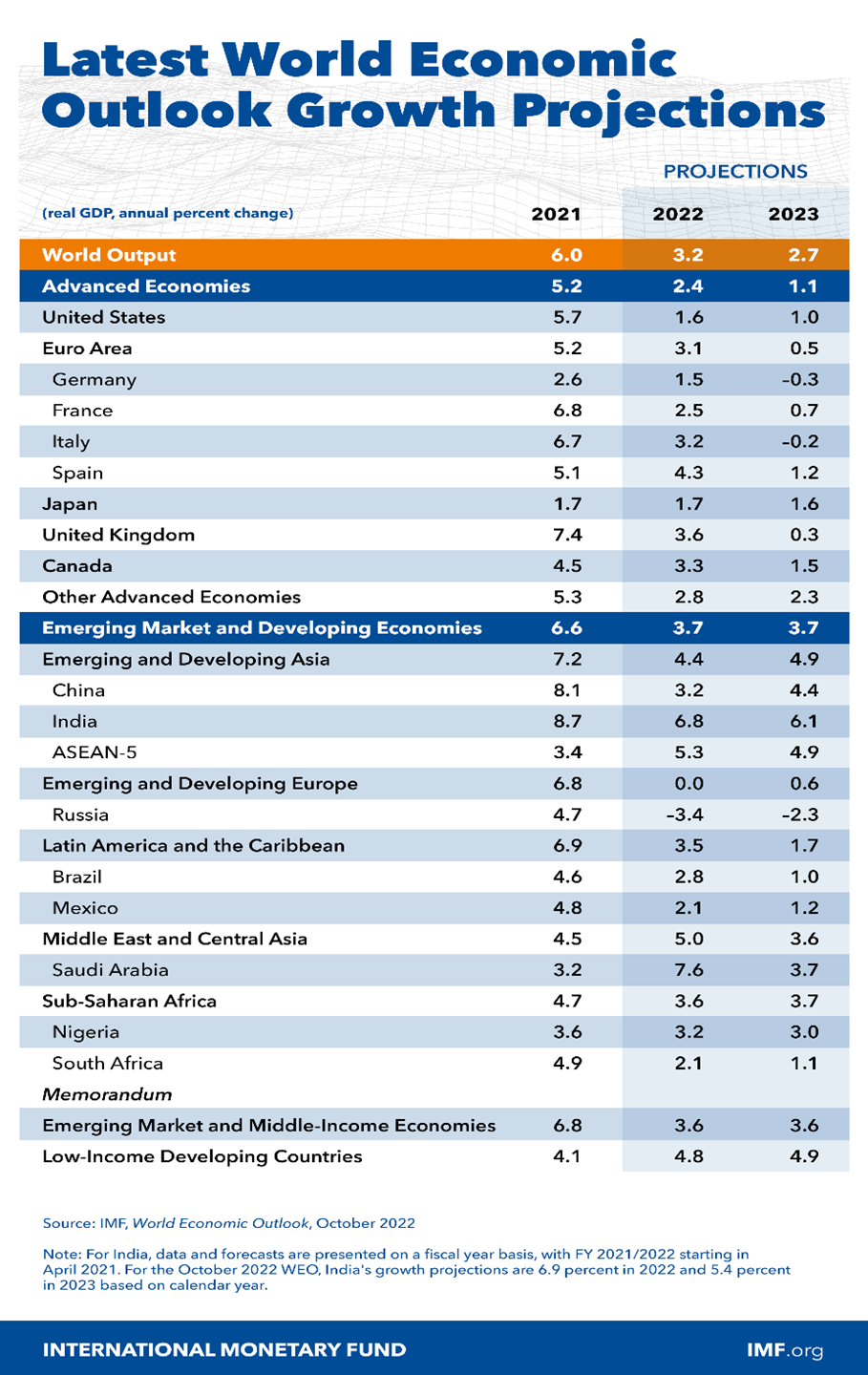

The above map from the IMF’s World Economic Outlook is an excellent depiction of how economies across the world will grow in 2022. As seen from the map, India is fortunate to be among those countries that will grow at over 6% this year. The forecast for India may look good, but the real scenario is actually different. Economists have pointed out that if India really wants to become a developed country, its economy will have to grow steadily for around a decade by around 8 to 10 per cent annually. This would be a herculean task for India simply because global economic growth has slowed down considerably and is predicted to be worse next year. Below is a table from the IMF with growth rates for various countries from 2021 to 2023.

As can be seen from the above table, global growth in 2023 is actually going to be lower for almost all countries as compared to 2022. This is not a good indicator and is important for India to realize that we need to counter the low rate of global growth by increased spending, especially by the government in infrastructure and by creating new avenues for employment.

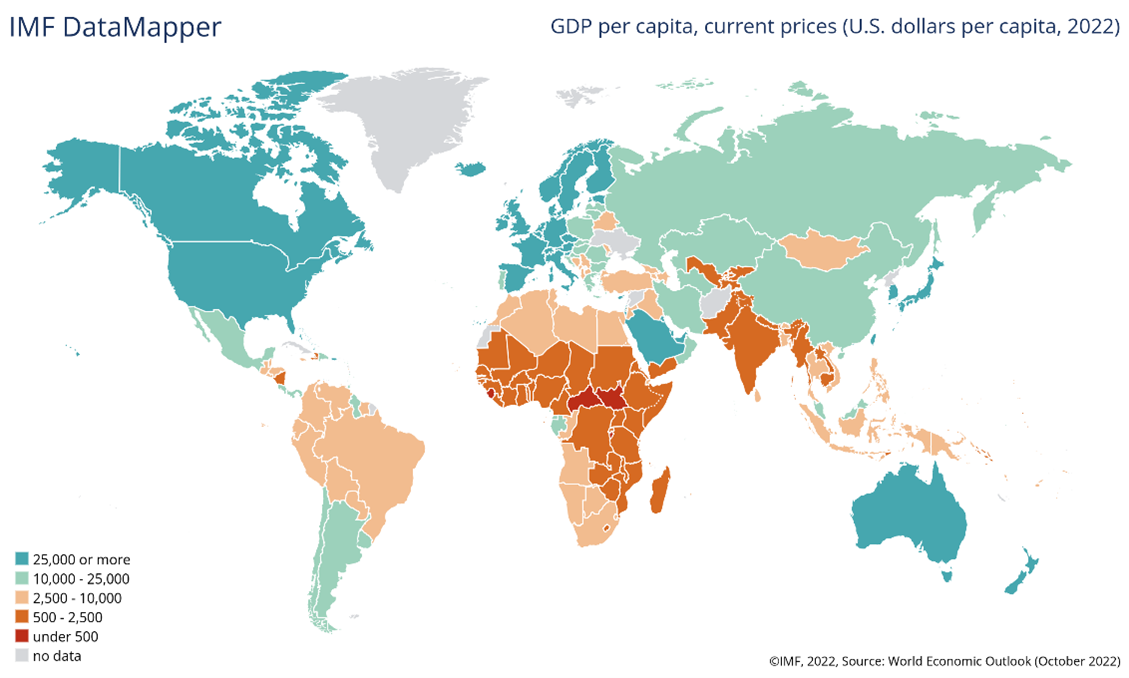

Though the scenario for India looks good compared to other countries, in reality, the picture is different. Let’s take a look at the picture below from the IMF on GDP Per Capita.

This map clearly shows that India’s GDP per capita is one of the lowest in the world. This simply means that the average income of the average Indian citizen is very low. This is proven by the fact that in 2021, the top 10 per cent of the Indian population in terms of pre-tax income was estimated to hold over 57 per cent of total income in India, whereas the bottom 50 per cent group accounted for only 13 per cent of the country’s income. This indicates that the income gap inequality in India is huge and the government needs to take serious note of this and introduce measures to reduce this inequality. This measure of GDP is extremely important as income equality is one of the drivers of growth and needs to be addressed to ensure that India becomes a truly developed nation.

Future of Economic Growth

The implications of the forecasts for GDP growth are very clear. The world is going through turmoil due to geopolitical developments and the effects of COVID-19. This has affected inflation, interest rates, employment and economic growth. The forecasts for 2022 are not good compared to 2021. And 2023 appears to be a year where global growth will come down further. This is not good news. Governments and companies across the world need to take measures to prevent a further slowdown in economic growth, especially with regard to inflation, interest rates and unemployment. Governments, even in high-growth countries like India, need to take note of the forecasts which do not paint a very positive picture and look at ways and means to boost growth. Companies, on the other hand, need to look for ways to increase their investments, but lower their costs and be prepared for lower consumption. They should also look at expanding their activities by investments and actively look at expanding their consumer base.

About the Author

|

VIJAY KUMAR VADDADI, India Entry & International Affairs

Mr. Vijay Kumar is an Industrial Economist with 35+ years of experience in Economic Analysis, Trade & Investment Promotion, International Business Strategy & Cross-Cultural Impact. A Post-Graduate in Economics with specialization in Industrial Economics and Economics of Transportation, Public Utilities & Social Infrastructure from the University of Bombay (1982). In 1984, he joined the Consulate General of the Netherlands in Mumbai as Economic & Commercial Officer and continued his association with the Netherlands Government (NBSO) for over 30 years. At SAS Partners, he heads the Trade and Investment Promotion activities, supports in organising programmes for international business delegations, curating knowledge reports, market studies and also helps our international clients in understanding the Indian business landscape better. |