INDIA’S FOREIGN DIRECT INVESTMENT – AN ANALYSIS

Foreign Direct Investment (FDI) has been growing at a healthy pace in India in the last decade. In 2022, India ranked 7th in terms of attracting FDI which is one rank above compared to 2021. In spite of the global economic slowdown due to the pandemic and the Russian invasion of Ukraine, India continued to attract FDI from across the globe.

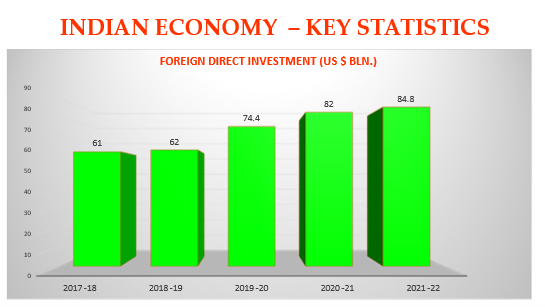

Foreign Direct Investment inflows to India, which stood at $45.15 billion during the financial year (FY) 2014-15 almost doubled during the FY 2021-22 to $84.84 billion which was the highest annual FDI ever received. Total FDI inflows received in the last 8 years (April 2014- March 2022) was $523 billion which amounts to nearly 40% of total FDI inflow since 2000.

The Indian Government’s favourable policies towards foreign investment have helped tremendously to attract FDI into the country. India came out with several favourable schemes and policies to attract foreign investors. Many schemes like Make in India, Production Linked Incentive (PLI) scheme and the Gati Shakti policies for logistics and industrial development have been successful in attracting FDI. India opened up new sectors like defence and aerospace, R&D and real estate thereby increasing the interest in investing in India.

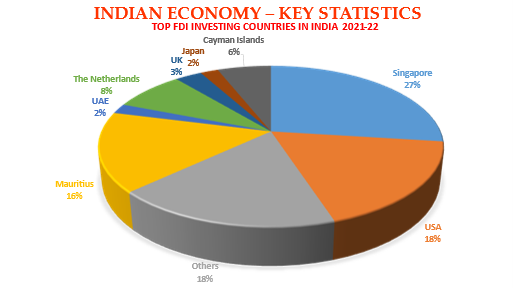

Sources of Foreign Direct Investment

Singapore (27.01%) and the USA (17.94%) have emerged as the top 2 sourcing nations in FDI equity flows into India in FY2021-22 followed by Mauritius (15.98%), the Netherlands (7.86%) and Switzerland (7.31%). The other major investing countries in India during the same period were the U.K., Japan, UAE, Cayman Islands and Germany.

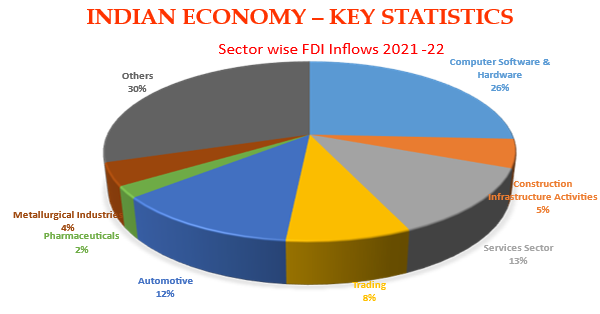

Sector-wise Foreign Direct Investment

The top 5 sectors receiving the highest FDI Equity Inflow during FY 2021-22 are Computer Software & Hardware (24.60%), Services Sector (Finance, Banking, Insurance, Non-Financial/Business, Outsourcing, R&D, Courier, Tech. Testing and Analysis, Other) (12.13%), Automobile Industry (11.89%), Trading 7.72% and Construction (Infrastructure) Activities (5.52%).

The top 5 States receiving the highest FDI Equity Inflow during FY 2021-22 are Karnataka (37.55%), Maharashtra (26.26%), Delhi (13.93%), Tamil Nadu (5.10%) and Haryana (4.76%)

The top 5 sectors receiving the highest FDI Equity Inflow during FY 2021-22 are Computer Software & Hardware (24.60%), Services Sector (Fin., Banking, Insurance, Non- Financial/Business, Outsourcing, R&D, Courier, Tech. Testing and Analysis, Other) (12.13%), Automobile Industry (11.89%), Trading 7.72% and Construction (Infrastructure) Activities (5.52%).

Routes & Policies – Foreign Direct Investment

There are two routes by which India gets FDI.

- Automatic route: By this route, FDI is allowed without prior approval by the Indian Government or Reserve Bank of India.

- Government route: Prior approval by the government is needed via this route. The application needs to be made through Foreign Investment Facilitation Portal.

- Sector-Specific Approvals: Depending on the sector the FDI is being invested in, there are sector-specific approvals and these vary from sector to sector.

- Prohibited Sectors: There are some sectors that are prohibited from foreign investment. These are, Lottery and related businesses; Gambling and betting including casinos; Certain kinds of non-banking financial companies; the Manufacture of tobacco and tobacco products; Atomic Energy; Railway operations; Certain specified real estate businesses.

Approval Process

Once an application is made, the Department of Promotion of Industry & Internal Trade (DPIIT) will identify the concerned Ministry/ Department and thereafter, circulate the proposal within 2 days. In addition, once the proposal is received, the same would also be circulated online to the Reserve Bank of India (RBI) within 2 days for comments from the Foreign Exchange Management Act (FEMA) division of the RBI for their perspective.

DPIIT would be required to provide its comments within 4 weeks from receipt of an online application, & Ministry of Home Affairs (if applicable) to provide comments within 6 weeks. If needed, additional information/ clarifications may be asked from the applicant which is to be provided within 1 week. Proposals involving FDI exceeding INR 50bn (approx. $775 million) shall be placed before the Cabinet Committee of Economic Affairs.

Investment Protection Treaties

Bilateral Investment (Protection) Treaties (BITs) are reciprocal agreements between two countries to promote and protect foreign investments in each other’s countries. BITs establish minimum guarantees between the two countries regarding the treatment of foreign investments, such as national treatment (treating foreign investors at par with domestic companies), fair and equitable treatment (in accordance with international law), and protection from expropriation (limiting each country’s ability to take over foreign investments in its territory).

Till 2015, India had signed BITs with 83 countries out of which 74 were in force. In 2015, India revised the draft BIT agreement and came out with what it called a Model BIT Agreement. Since then, India terminated its BITs with 77 countries, has signed investment treaties with only 4 countries and is still in negotiations with 37 countries.

The Future Scenario – Foreign Direct Investment

India has done reasonably well with regard to FDI as compared to most countries. It has attracted foreign investors in a number of industries due to its political stability, democratic government, huge pool of technically qualified youth, lower costs and huge domestic market. India also has geographical advantages and could be the gateway to the southeast Asian markets.

Considering the fact that India is now the sixth largest economy in the world and also the fastest growing large at an estimated GDP growth of 6% for 2023, it can do much better in inviting even higher levels of FDI. It could attract far greater investments from foreign companies if it is able to improve its infrastructure, reduce bureaucratic procedures, eliminate corruption, simplify the complex taxation system, reduce the huge customs duties, get rid of the protectionist policies and do away with the endless delays due to various factors.

SAS Partners – Your India Entry Partner

SAS Partners Corporate Advisors Private Limited is a homegrown corporate advisory organization and has been in the forefront of promoting cross-border investment and trade with India as a focal point for over 12 years. Headquartered in Chennai, with branch offices in Bangalore and Dubai, we have developed an international orientation with a global clientele.

We have proven credentials of helping foreign companies enter the Indian market and European countries/regions and attracting Indian companies to invest in their regions. SAS Partners has the experience and expertise to not only assist individual companies but has also successfully helped government organizations like Brussels Invest & Export (Ministry of Brussels Capital Region and various bilateral chambers by supplementing their efforts through our expertise and that of our highly experienced advisors. We provide a bouquet of services for companies that are looking to invest in India and can be your ideal partner, not only to enter India but to also grow and become successful in the country.

About the Author

|

VIJAY KUMAR VADDADI, India Entry & International Affairs

Mr. Vijay Kumar is an Industrial Economist with 35+ years of experience in Economic Analysis, Trade & Investment Promotion, International Business Strategy & Cross-Cultural Impact. A Post-Graduate in Economics with specialization in Industrial Economics and Economics of Transportation, Public Utilities & Social Infrastructure from the University of Bombay (1982). In 1984, he joined the Consulate General of the Netherlands in Mumbai as an Economic & Commercial Officer and continued his association with the Netherlands Government (NBSO) for over 30 years. At SAS Partners, he heads the Trade and Investment Promotion activities, supports organising programmes for international business delegations, curates knowledge reports, and market studies and also helps our international clients in understanding the Indian business landscape better. |