Introduction on Foreign Trade and Investment

Trends in global trade and investments are indicators of what is in store for countries across the world. Increased trade and investment indicate that a country’s economy is on the right path. COVID-19, Russia’s invasion of Ukraine and related geopolitical events have hurt trade and investment flows which in turn affected the growth of economies.

The biggest factors that affect GDP growth are trade and investment. Higher inflation and increases in interest rates in almost all major economies has compounded the problems related to trade and investment flows. Lets take a close look at how global trade and investments were affected during the last two years and what impact this has had on the Indian economy. India’s economy appears to be more resilient and better placed compared to most of the large economies as we shall see later in the article.

The Outlook for Global Trade

The World Trade Organisation, in its 2022 report states:

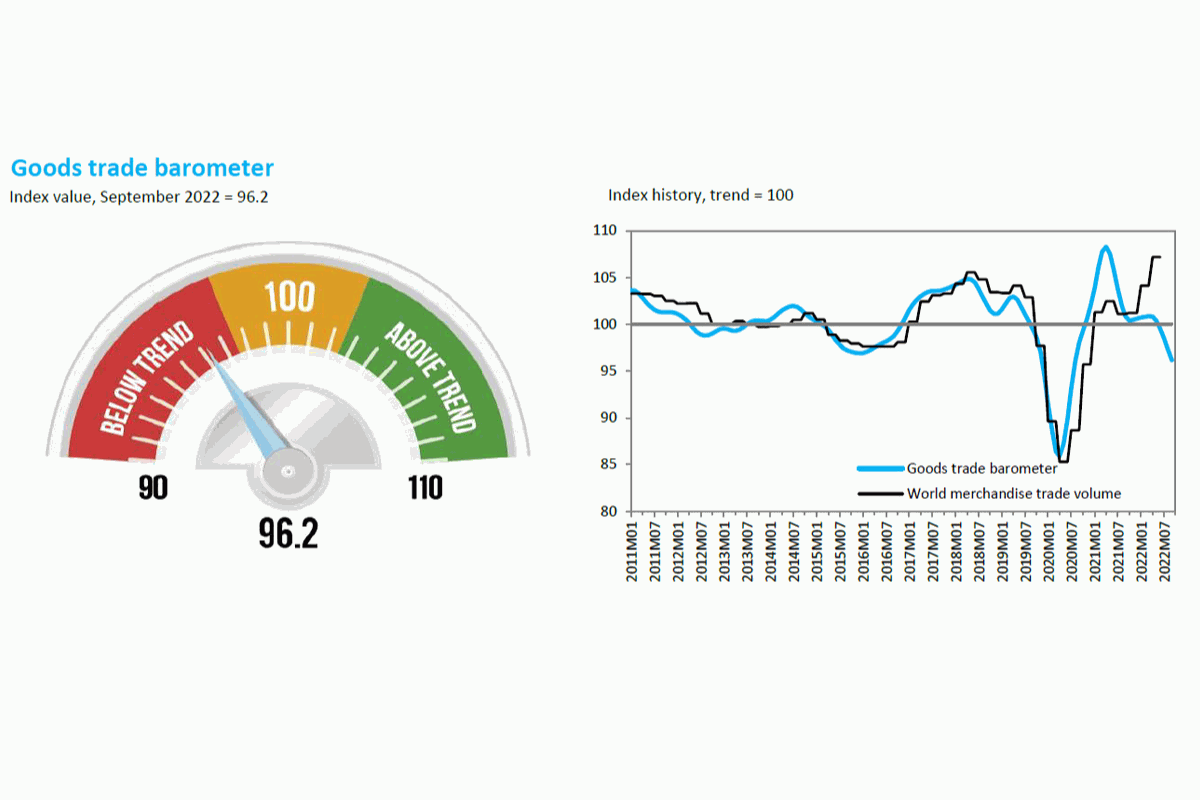

“World trade is expected to lose momentum in the second half of 2022 and remain subdued in 2023 as multiple shocks weigh on the global economy. WTO economists now predict global merchandise trade volumes will grow by 3.5% in 2022—slightly better than the 3.0% forecast in April. For 2023, however, they foresee a 1.0% increase—down sharply from the previous estimate of 3.4%. Trade and output will be weighed down by several related shocks, including the war in Ukraine, high energy prices, inflation, and monetary tightening.”

WTO is of the view that a slowdown in trade and investment is inevitable during 2023. A report by the United Nations Conference on Trade & Development (UNCTAD) makes similar forecasts. According to the UNCTAD report, global trade should touch $32 trillion in 2022, which is a record. The report states that trade in goods grew 10% from last year to an estimated $25 trillion, due in part to higher energy prices. Services were up 15% to a record $7 trillion. However, a slowdown was witnessed during the second half of 2022.

The World Trade Organization’s Goods Trade Barometer sees global trade growth slowing down. Image: World Trade Organization

In spite of the negative outlook for 2023, global trade not only remained resilient but grew to record levels in spite of the effects of the pandemic in early 2022. This was largely due to the pent-up demand which could not be satiated in 2020 and 2021 when economies were faced with closure. As countries eased the strict COVID-related policies during the second half of 2021, demand picked up and this resulted in record trade figures during the first half of 2022.

But as demand began to slow down due to Russia’s invasion of Ukraine, high inflation, increased interest rates and sky-high energy prices, demand for goods and services gradually started falling during the second half of 2022. This trend is expected to continue during 2023.

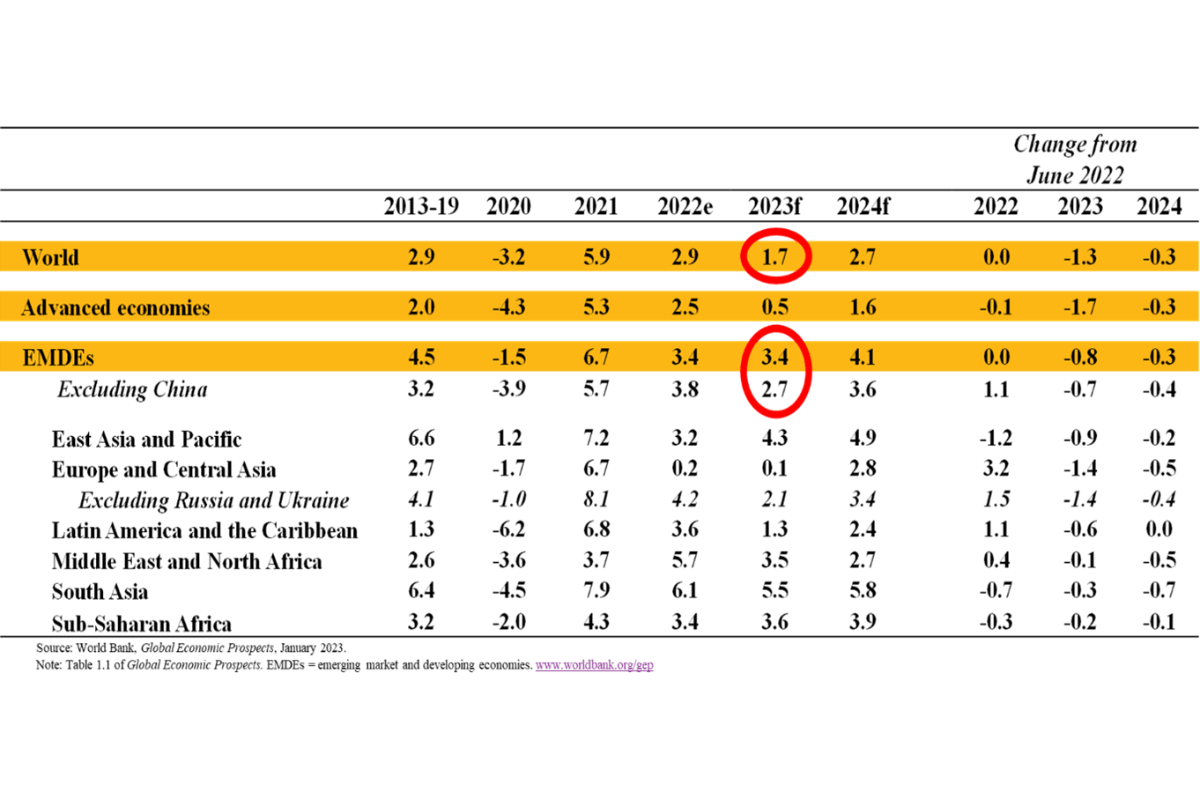

The World Bank too, in its report ‘Global Economic Prospects’ published in January 2023, also states that global trade growth is expected to decelerate further to 1.6 per cent in 2023. The report states that this reflects weakening global demand. Emerging markets and developing economies are likely to be more vulnerable, especially those countries that are dependent on exports to major economies as these economies will be facing a slowdown in growth.

The report states that weaker-than-expected global demand and renewed supply chain bottlenecks will result in downside risks to the global trade outlook. This, in turn, could be aggravated by increased trade protectionism, which will increase trade costs and slow trade growth.

World Bank’s Global Growth Forecasts

The Outlook for Foreign Direct Investment

The effects of the pandemic on FDI in 2020 are very obvious and resulted in a tremendous slowdown in FDI flows across the globe. Closure of economies, especially manufacturing units, resulted in huge losses for companies and reduced new investments to a trickle. The World Bank, in its ‘Global Economic Prospects’ report also comments on the investment outlook for the coming years and the issues that will be faced by many countries, developed as well as emerging markets and developing economies (EMDEs). It states:

“After a robust rebound in 2021, investment growth is projected to average 3.5 per cent per year in EMDEs and 4.1 per cent in EMDEs excluding China in 2022-24, below the long-term (2000-21) average rates for both country groups. Commodity-exporting EMDEs are projected to have lower investment growth rates than tourism-reliant EMDEs. For all EMDEs, projected investment growth through 2024 will be insufficient to return investment to the level suggested by the pre-pandemic trend from 2010-19, in part due to slowing investment growth in China.

Investment in EMDEs excluding China, however, is projected to return to the pre-pandemic trend by 2024. Uncertainties about the post-pandemic economic landscape, the war in Ukraine, and high inflation may discourage investment for some time. Tighter financial conditions are limiting the fiscal support governments can provide to stimulate public investment.”

The message from the World Bank’s latest report is clear. 2023 is not going to be a great year for new investments, especially in the private sector. Emerging and developing economies are likely to face the brunt of the investment slowdown. Since trade and investment are two sides of the same coin, lower investments will, in turn, lead to a weakening in trade.

Again, the picture of global investment flows is very similar to trade flows. The UNCTAD’s Global Investment Report in June 2022 states that foreign direct investment (FDI) flows in 2021 were $1.58 trillion, up 64 per cent from the exceptionally low level in 2020. However, the global environment for cross-border investments changed completely in 2022. According to a report by the OECD, global FDI flows amounted to $972 billion during the first half of 2022.

Most of the increase came in the first quarter of 2022 and FDI flows actually decreased by 22% during the second quarter of the year. The abrupt decrease is very obviously the effect of Russia’s invasion of Ukraine and the effects of the geopolitical developments that resulted from the invasion. The USA was the largest recipient of FDI flows, followed by China and Brazil during the first half of 2022. India was the seventh-largest recipient of FDI during the same period.

The Outlook for India

India appears to be in a much better position with regard to foreign trade and investments. To be sure, India did suffer from the effects of the pandemic but not so much from Russia’s invasion of Ukraine and the consequent geopolitical developments. The Indian economy has been far more resilient as compared to most emerging and developing economies and has fared much better. Both, in trade and investments, India presented a picture of hope and resilience.

The World Bank, in its latest report states:

“India’s economy has been remarkably resilient to the deteriorating external environment, and strong macroeconomic fundamentals have placed it in good stead compared to other emerging market economies,” said Auguste Tano Kouame, World Bank’s Country Director in India. “However, continued vigilance is required as adverse global developments persist.”

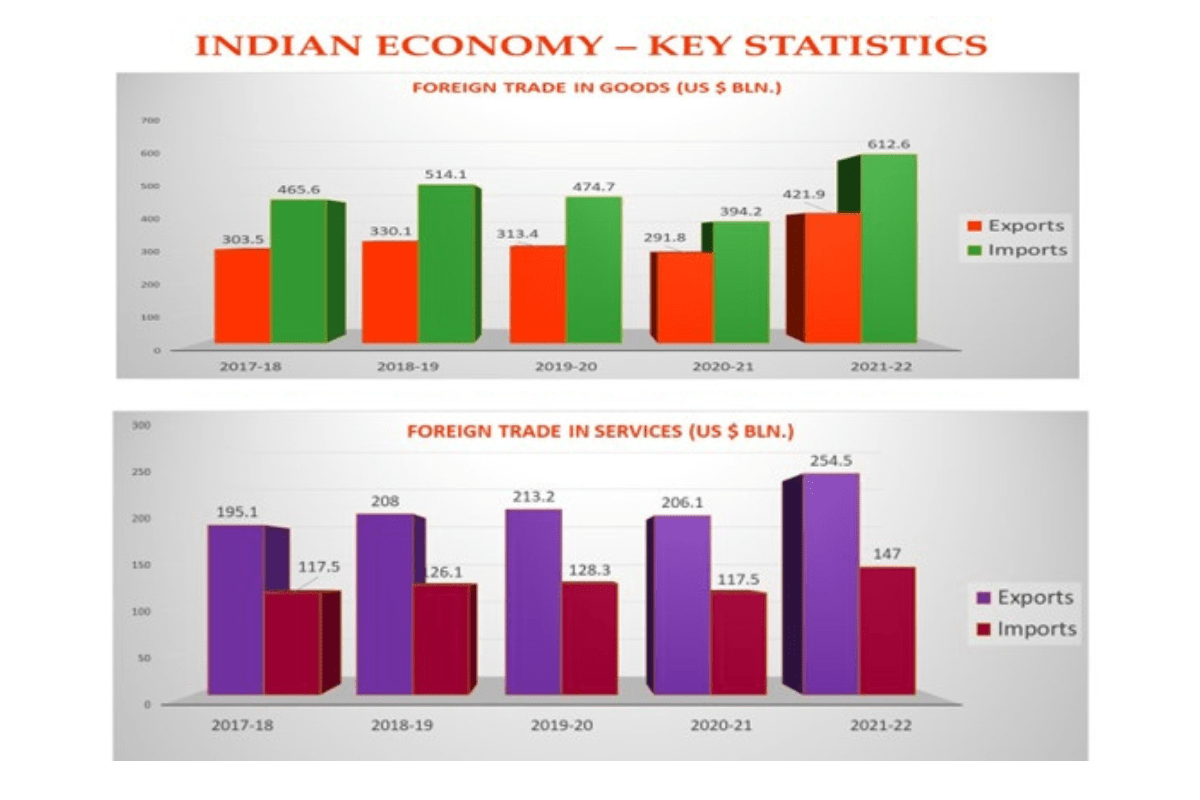

In FY 2020-21, India’s exports and imports of goods stood at $291.8 billion and $394.2 billion respectively. But, in FY 2021-22, India registered impressive growth with exports growing to $421.9 billion and imports growing to $612.6 billion. This growth is extraordinary, especially when benchmarked with other EMDEs. The trade-in services too grew, though not at a dramatic rate. In FY 2020-21, India’s exports of services stood at $206.1 billion and imports stood at $117.5 billion. In FY 2021-22, India’s exports of services grew to $254.5 billion and imports were valued at $147 billion.

The first six months of FY 23 also depict positive results for India’s foreign trade. India’s overall exports (Merchandise and Services combined) in April-November 2022 are estimated to be $499.67 billion. Overall imports in April-November 2022 are estimated to be $610.70 billion.

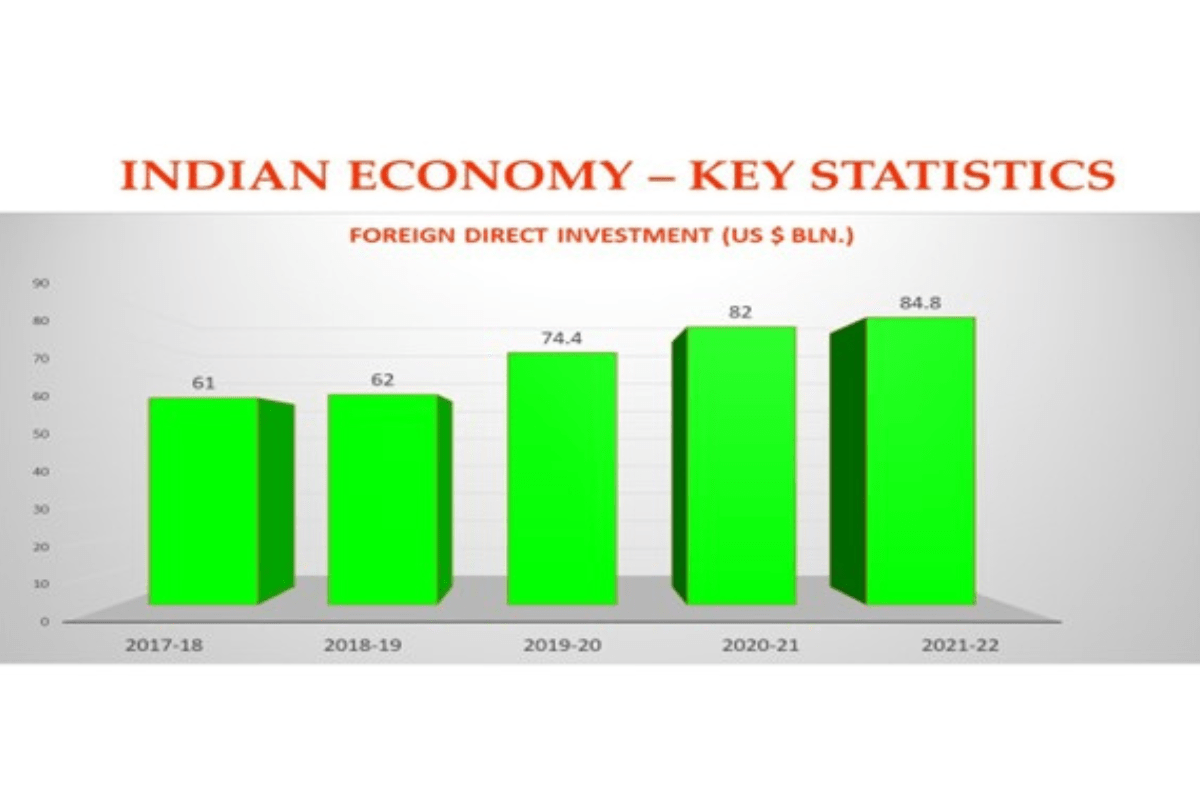

India’s inward foreign investments showed growth, but at a slower pace. In FY 2020-21, India’s inward FDI amounted to $82 billion and in FY 2021-22, India received $84.8 billion. In 2022, India became the seventh-largest recipient of FDI in the world.

The appreciation of the US Dollar against the Indian Rupee and the much higher growth in imports has reduced India’s foreign exchange reserves considerably by around $100 billion. In March, India’s forex reserves stood at $617.7 billion. But this has reduced to $561.58 billion in the second week of January 2023. Since India is a large importing country, it needs large foreign exchange reserves and such a sharp drop in 9 months of FY 2022-23 is not a good sign.

Conclusion

The forecasts for foreign trade and investments for 2023 are not very positive. Nevertheless, India is a bright spot in the gloomy outlook for the coming year. But this does not mean that we can be complacent as new and unknown shocks can upset India’s resilience. The outlook for India for FY 2022-23 and FY 2023-24 is positive but not great for India.

Though India did show a strong capability to withstand the shocks inflicted by the pandemic and the geopolitical developments, it will suffer lower growth in the current year followed by even lower growth in the coming year. India’s GDP is expected to come down to 6.6% in FY 2022-23 compared to 8.7% in 2021-22 and this is expected to further decline to around 6.1% in FY 2022-23. This is because global growth itself will register negative growth.

Some of the most important risk factors for not just India, but for the entire world in 2023 are:

- High inflation

- Rising interest rates

- High oil prices

- Higher rates of unemployment

- Reduced demand

- Supply chain issues

- Geopolitical developments

- Environment and climate change challenges

In spite of the lower growth forecasts, India is most likely to be the fastest-growing large economy in the world. EMDEs, the EU, Latin America and most of Asia are expected to register lower growth. The USA too is expected to slow down in 2023. These developments will impact the Indian economy adversely in the coming 18 months. Indian companies that are export dependent or looking for foreign investment to grow and expand are likely to face problems in the coming year.

However, the Indian Government has invested heavily in capital expenditure in FY 2022-23 and is likely to continue to do so. This will help to boost the country’s economy and reduce the impact of global shocks. India can be cautiously optimistic that when compared to most large economies in developed and developing countries, the country’s position appears to be better off.

About the Author

|

VIJAY KUMAR VADDADI, India Entry & International Affairs

Mr. Vijay Kumar is an Industrial Economist with 35+ years of experience in Economic Analysis, Trade & Investment Promotion, International Business Strategy & Cross-Cultural Impact. A Post-Graduate in Economics with specialization in Industrial Economics and Economics of Transportation, Public Utilities & Social Infrastructure from the University of Bombay (1982). In 1984, he joined the Consulate General of the Netherlands in Mumbai as an Economic & Commercial Officer and continued his association with the Netherlands Government (NBSO) for over 30 years. At SAS Partners, he heads the Trade and Investment Promotion activities, supports organising programmes for international business delegations, curates knowledge reports, and market studies and also helps our international clients in understanding the Indian business landscape better. |