World Economic Outlook – Important facts about the Global Economic Growth

The International Monetary Fund (IMF) publishes the “World Economic Outlook” twice a year, in October and January. The IMF tries to analyse the global economic situation across various regions and countries and forecasts economic trends for the coming year.

The theme of the latest report released by the IMF is “Inflation Peaking Amid Low Growth”. Essentially, the IMF is saying that the forecast for 2023 is about inflation levels peaking or coming down but economic growth will be lower in most parts of the world compared to 2022.

The IMF states that the global fight against inflation and Russia’s war in Ukraine will be the most important factors affecting global economic growth in 2023.

World Economic Outlook – Global Growth

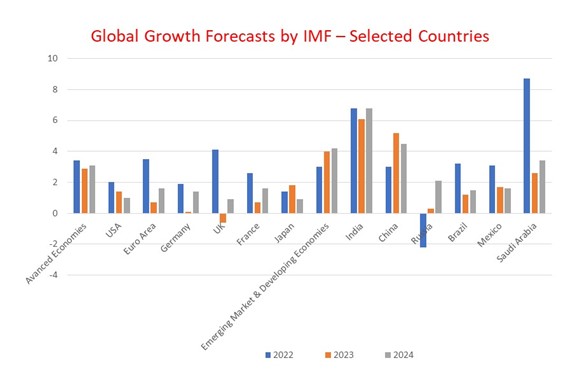

- Global growth, estimated at 3.4% in 2022, is projected to fall to 2.9% in 2023 before rising to 3.1% in 2024.

- Negative growth in global GDP or global GDP per capita—which often happens when there is a global recession—is not expected.

- The forecast of low growth in 2023 reflects the rise in interest rates by central banks to fight inflation and the Ukraine crisis.

- The decline in growth in 2023 from 2022 is driven by advanced economies; in emerging markets and developing economies, growth is estimated to have bottomed out in 2022.

- For advanced economies, growth is projected to decline sharply from 2.7% in 2022 to 1.2% in 2023 before rising to 1.4% in 2024, with a downward revision of 0.2% point for 2024. About 90% of advanced economies are projected to see a decline in growth in 2023.

World Economic Outlook – Global Growth in Advanced Economies

- In the United States, growth is projected to fall from 2.0% in 2022 to 1.4% in 2023 and 1% in 2024, with growth rebounding in the second half of 2024.

- Growth in the Euro Area is projected to bottom out at 0.7% in 2023 before rising to 1.6% in 2024.

- Growth in the United Kingdom is projected to be –0.6% in 2023, a 0.9% point downward revision from October.

- Growth in Japan is projected to rise to 1.8% in 2023. In 2024, growth is expected to decline to 0.9%.

World Economic Outlook – Global Growth in Emerging Economies

- For emerging markets and developing economies, growth is projected to rise modestly, from 3.9% in 2022 to 4% in 2023 and 4.2% in 2024. About half of emerging markets and developing economies have lower growth in 2023 than in 2022.

- Growth in emerging and developing Asia is expected to rise in 2023 and 2024 to 5.3% and 5.2%, respectively, after the deeper-than-expected slowdown in 2022 to 4.3% attributable to China’s economy.

- Growth in India is set to decline from 6.8% in 2022 to 6.1% in 2023 before picking up to 6.8% in 2024, with resilient domestic demand despite external headwinds.

- Growth in China is projected to rise to 5.2% in 2023, reflecting rapidly improving mobility, and to fall to 4.5% in 2024 before settling at below 4% over the medium term amid declining business dynamism and slow progress on structural reforms.

- Growth in the ASEAN-5 countries (Indonesia, Malaysia, Philippines, Singapore, Thailand) is projected to slow to 4.3% in 2023 and then pick up to 4.7% in 2024.

- Growth in emerging and developing Europe is projected to have bottomed out in 2022 at 0.7% and, since the October forecast, has been revised up for 2023 by 0.9% point to 1.5%.

- In Latin America and the Caribbean, growth is projected to decline from 3.9% in 2022 to 1.8% in 2023.

- Growth in the Middle East and Central Asia is projected to decline from 5.3% in 2022 to 3.2% in 2023.

- In sub-Saharan Africa, growth is projected to remain moderate at 3.8% in 2023 In South Africa, projected growth more than halves in 2023, to 1.2%, reflecting weaker external demand, power shortages, and structural constraints.

World Economic Outlook – Global Inflation

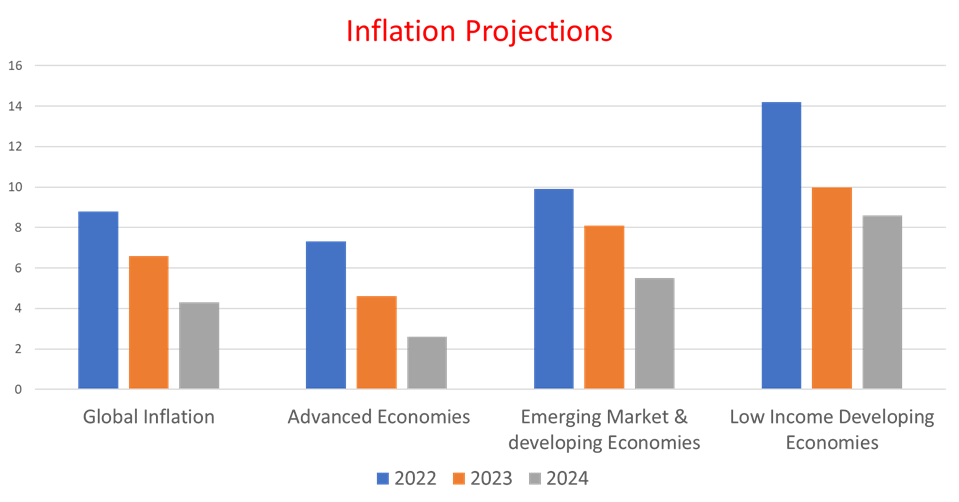

- About 84% of countries are expected to have a lower headline (consumer price index) inflation in 2023 than in 2022. Global inflation is set to fall from 8.8% in 2022 (annual average) to 6.6% in 2023 and 4.3% in 2024.

- By 2024, projected annual average headline and core inflation will, respectively, still be above pre-pandemic levels in 82% and 86% of economies.

- In advanced economies, annual average inflation is projected to decline from 7.3% in 2022 to 4.6% in 2023 and 2.6% in 2024.

- In emerging markets and developing economies, projected annual inflation declines from 9.9% in 2022 to 8.1% in 2023 and 5.5% in 2024, above 4.9%.

- In low-income developing countries, inflation is projected to moderate from 14.2% in 2022 to 8.6% in 2024.

World Economic Outlook – Global Risks

The IMF has listed the potential risks to the global economy in 2023:

Downside Risks:

- China’s recovery from COVID-19 stalling

- The war in Ukraine escalating

- Debt distress among many low-income and emerging economies

- Persistence of high inflationary tendencies in many countries

- Volatility in financial markets

- Geopolitical fragmentation

Upside Risks:

- Pent up demand

- Faster disinflation

World Economic Outlook – Global Policy Priorities

The IMF has suggested that countries should prioritise policies to enhance recovery in 2023

- Achieving a sustained reduction in inflation

- Efforts to boost vaccination and contain the pandemic

- Ensuring financial sector stability to reduce vulnerabilities

- Restoring debt sustainability to restrict the effects of low growth and high borrowing costs

- Supporting the vulnerable, especially with rising energy, food and housing costs

- Reinforcing supply to eliminate supply-side factors that inhibit the growth

- Strengthening multilateral cooperation to avoid geopolitical fragmentation

- Strengthening global trade

- Speeding the green transition

About the Author

|

VIJAY KUMAR VADDADI, India Entry & International Affairs

Mr. Vijay Kumar is an Industrial Economist with 35+ years of experience in Economic Analysis, Trade & Investment Promotion, International Business Strategy & Cross-Cultural Impact. A Post-Graduate in Economics with specialization in Industrial Economics and Economics of Transportation, Public Utilities & Social Infrastructure from the University of Bombay (1982). In 1984, he joined the Consulate General of the Netherlands in Mumbai as an Economic & Commercial Officer and continued his association with the Netherlands Government (NBSO) for over 30 years. At SAS Partners, he heads the Trade and Investment Promotion activities, supports organising programmes for international business delegations, curates knowledge reports, and market studies and also helps our international clients in understanding the Indian business landscape better. |