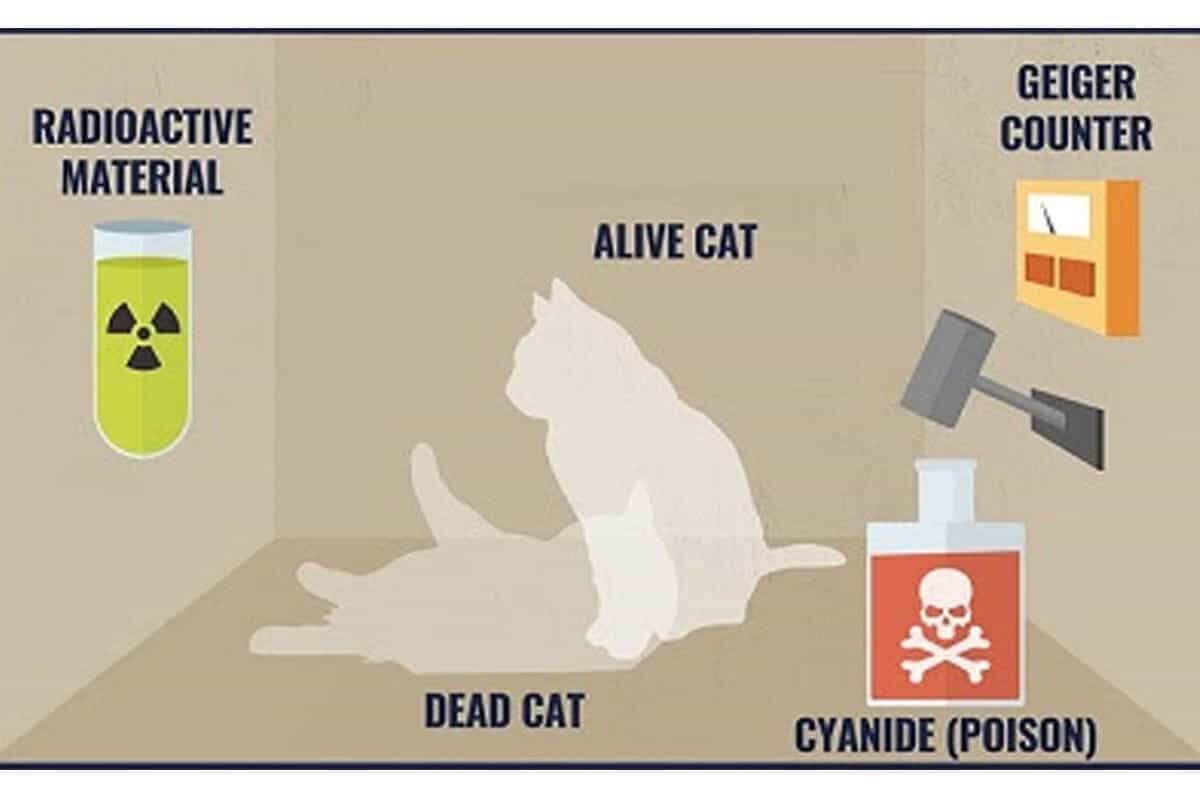

Schrödinger’s Cat?

Erwin Schrodinger was an Austrian physicist who developed the thought experiment to illustrate quantum superposition, where a cat was placed with a flask of poison and radioactive source inside a

The French Presidential Visit – 2018

France and India are old friends. Both countries share deep affinities and unwavering trust since India’s independence. Thanks to early initiatives, we’ve seen individual friendships as between

Registered Valuers

Valuation is necessary not only for making critical business decisions but also to comply with provisions of various statutes. Different type of valuation methodology and reporting is adopted for

NBFC – Peer to Peer Lending Platform (Reserve Bank) Directions, 2017

The Reserve Bank of India (RBI) on 04th October 2017 had come out with a Master Directions for the peer-to-peer (P2P) lending marketplace that until now remained without any regulations.The P2P l

Insolvency And Bankruptcy Code – Why, What And How!

The Government of India has been bringing out various legislation and regulations to ease the doing of business in India. One of the key issues faced by any form of business is debt recovery. The

Why work with us?

Chicken or Egg? – Investor or Customer?

For some time now, I see start-up founders fond of attracting investors more than customers. A couple of days back; I received an email from one of our clients, a start-up promoter asking this: “

Valuations for JV’s/Strategic Alliances

Hi there, I’m back. I realize that you are making less sense out of my blogs than what I’d anticipated. If it was to be otherwise, I should’ve clocked at least one bonus in ma paycheck! Mm, I can

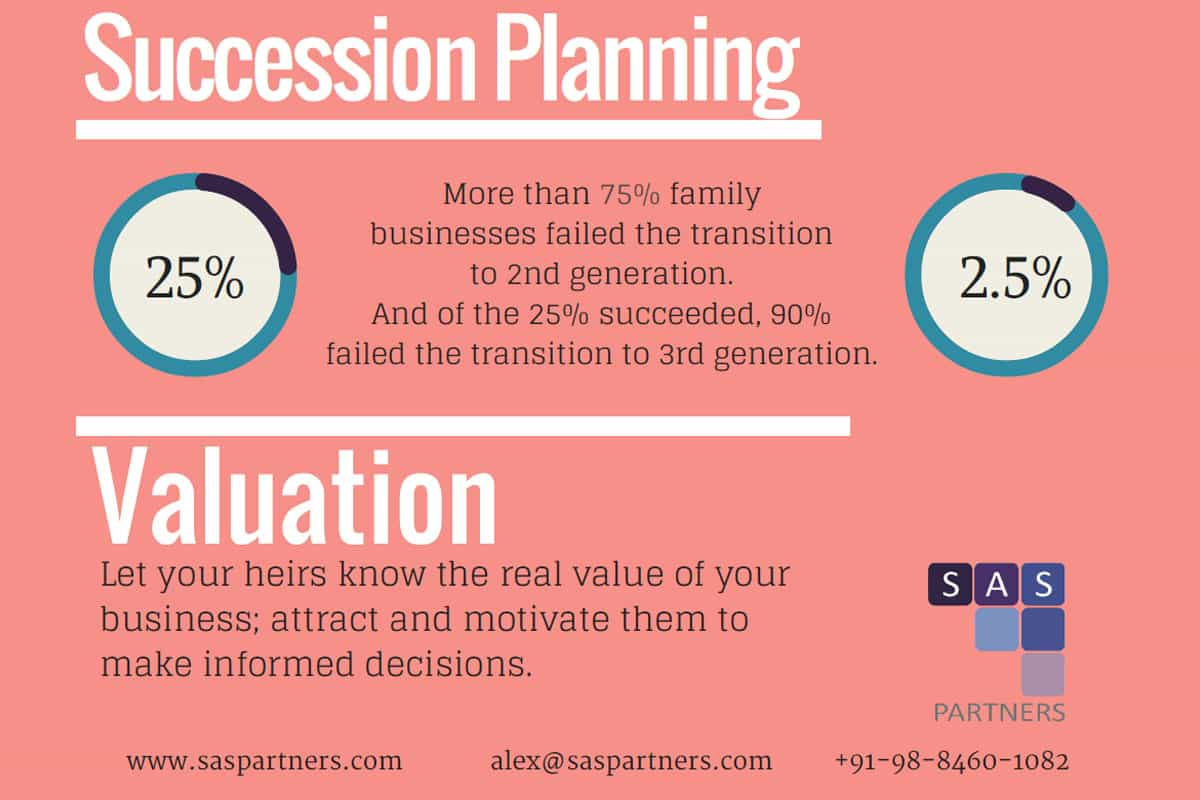

Valuations for succession planning

Hi folks, thanks for stepping by. Hope you could read through our last blog and make some sense. If not, please email me in person: I may have to rethink on what I’ve been writing. (I will give

Valuations_ Going for Fund raising?

The culture of opening doors to venture capital/private equity investments has transformed the way businesses have grown and evolved. The stories of mighty unicorns are no longer hard to come by.